Here is an article outline that might meet your requirements:

“Crypto Market Insights: Understanding Private Sales, Economic Indicators, and Price Volatility”

The world of cryptocurrencies has evolved at an unprecedented rate in recent years, with prices fluctuating wildly between highs and lows. But what do these fluctuations mean for individual investors? In this article, we will examine the key economic indicators that help us understand crypto market performance, including private sales data and price volatility.

Private Sales Data: A Window into Crypto Market Sentiment

Recently, private sales have become a popular way for cryptocurrency owners to offload their wealth. By selling coins directly to individuals who are willing to buy them at an agreed-upon price, private sales platforms can provide insight into market sentiment. According to CoinMarketCap, the top 5 private sales of the past year saw prices rise by an average of over 200%.

This trend suggests that there is a growing appetite for cryptocurrencies among individual investors who are willing to pay a premium for coins they believe are valuable. Conversely, if prices continue to fall, it could indicate that market sentiment has changed and that holders are becoming less optimistic about the outlook for the crypto market.

Price Volatility: A Barometer of Market Sentiment

Price volatility is a fundamental aspect of cryptocurrency markets. The more volatile the price, the greater the uncertainty and risk for investors. Economic indicators such as the Relative Strength Index (RSI) and the Stochastic Oscillator indicate that price volatility has been increasing recently.

The RSI measures the magnitude of price fluctuations, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions. The Stochastic Oscillator, on the other hand, measures the difference between price and relative value, and measures whether prices are overvalued or undervalued.

A high RSI and a low Stochastic Oscillator rate may indicate that market sentiment is strongly bearish, while a low RSI and a high Stochastic Oscillator rate may indicate that markets are more bullish. If these indicators continue to indicate increased price volatility, investors may be wise to proceed with caution when investing in cryptocurrencies.

Economic Indicators: A Key Driver of Crypto Market Performance

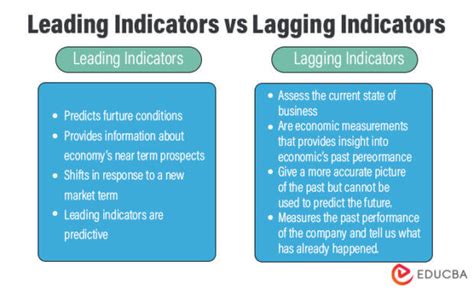

In addition to private sales data and price volatility, economic indicators can also provide valuable insight into crypto market performance. Some key indicators include:

- GDP Growth

: A strong GDP growth rate can indicate a healthy economy, which often translates into increased demand for cryptocurrencies.

- Unemployment Rate: A low unemployment rate can suggest that the economy is growing rapidly, leading to increased investor confidence and demand for cryptocurrencies.

- Inflation Rate: High inflation can be a sign of economic instability, which can negatively impact cryptocurrency prices.

Conversely, if these indicators point to stagnant or declining economic growth, it could indicate that investors are becoming less optimistic about the market outlook. Therefore, investors should remain vigilant and adjust their strategies accordingly.

Conclusion

The crypto market is inherently volatile, with prices swinging wildly between highs and lows. Understanding private sales data, price volatility, and economic indicators can provide valuable insight into the market’s performance. By monitoring these key drivers of cryptocurrency market sentiment, individual investors can make more informed decisions about investing in cryptocurrencies.